block input tax malaysia

Example 3 Hurry Sdn. Input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of business.

Asia Tax Bulletin Winter 2021 22 Perspectives Events Mayer Brown

Income Tax Treatment for GST Document 1116 kB.

. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns. Input tax is defined as the GST incurred on any purchase or acquisition of goods and services by a taxable person for making a taxable supply in the course or furtherance of business.

Bhd a GST registered International Procurement Center undertakes procurement and sale. Income tax treatment on block input tax that is not tax allowable. If both husband and wife are high-income earners filing for separate assessment is an obvious and easy.

I know this is easily available but there are many consultants who still are not aware for all new functionality. Goods and Services Tax GST is a tax on the consumption of goods and services in Malaysia and is levied on the value added at each stage of the supply chain. The CBICs latest circular is intended at clarifying all these aspects.

Malaysia GST Blocked Input Tax Credit. GST incurred input tax would be a deductible expense under section 331 of the Income Tax Act 1967 ITA if the underlining expense to which GST input tax is attributable is wholly and exclusively incurred in the production of gross income and is not prohibited by any provision under section 391 of the ITA. 70 reduction for Sabah and 50.

Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia. ITC being the backbone of GST and there are many condition to claim ITC on any items. ITC is used for payment of output tax.

Family benefits for staff. Input tax claims are disallowed under Regulation 26 of the GST General Regulations. GST Malaysia Section 4 Non-Allowable Input Tax Bad Debts Relief Record Keeping and Offences Penalties NON ALLOWABLE INPUT TAX While is general input tax is claimable under Standard and Zero-rated supplies there are certain instances where.

Expenses for use of club facilities Eg. Imposition of Sales Tax 4. The best would be via the IRBs own online platform ByrHASILIts the only online platform that supports payment by credit cards Visa Mastercard and American Express so you can earn some points or cashback for paying income tax just note that there is a processing.

You can also block or cancel your card by contacting 03-2714 8888 Touch n Go Careline Center 700 am to 1000 pm daily including public holidays. Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. Under the GST category businesses are allowed to claim GST incurred on purchase of most goods and services.

Meanwhile for those earning above RM1 million the tax rate was increased from 25 to 28. RM150000 RM4000 ii The garment manufacturer is entitled to claim input tax since the value of exempt supplies is less than RM5000 per month and does not exceed 5 of the total value of all supplies. What is Blocked Input Tax Credit in GST.

Blocked Input Tax Credit ITC of GST. Take example of Hilux 25Gs road tax of RM46036 in Sabah and Sarawak since Hilux has diesel engine and 4WD the road tax is further being reduced ie. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services.

Or connect with Investor Relations at 1-415-536-6250. Upon the input tax deduction if the input tax amount exceeds that of the output tax the taxable person would be in a refund position where he is entitled to a refund of the exceeded amount from the Director General DG13. Where there is no amount of output tax in the final return a registered person shall make an adjustment by declaring the amount of adjusted output tax as his input tax in column 6b of the GST-03 return.

For example if a buyer is entitled to avail input tax credit of Rs 10 lakh on. Green fees buggy fees rental of golf bag locker and dining at club restaurants. One of the key elements under the GST regime is the recoverability of GST incurred on business expenses by a taxable person ie.

Income tax treatment on block input tax that is capital expenditure subject to qualifying expenditure. Supply if made in Malaysia. A specific Sales Tax rate eg.

Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods. Which would be taxable supplies if made in Malaysia. In Budget 2016 the tax rate for those earning an income between RM600000 and RM 1 million was increased from 25 to 26 for year of assessment 2016.

Hurry issued a credit note on. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones. By far online payment is the easiest and most efficient way to pay income tax in Malaysia.

GUIDE ON INPUT TAX CREDIT As at 4 JANUARY 2017. Blocked input tax refers to input tax credit that you cannot claim. The basic fundamental of GST Malaysia is its self-policing features which allow the businesses to claim their Input tax credit by way of automatic deduction in their accounting system.

Income tax treatment on the disposal of passenger motor car. Input tax claims are allowed subject to the conditions for input tax claim. GST in Malaysia is proposed to replace the current consumption tax.

Exceptional input tax credit claim. Sunday 11 June 2017 1611. 9 company tax to 100mil revenue.

Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia. 030 Malaysian ringgits MYR per litre is applicable.

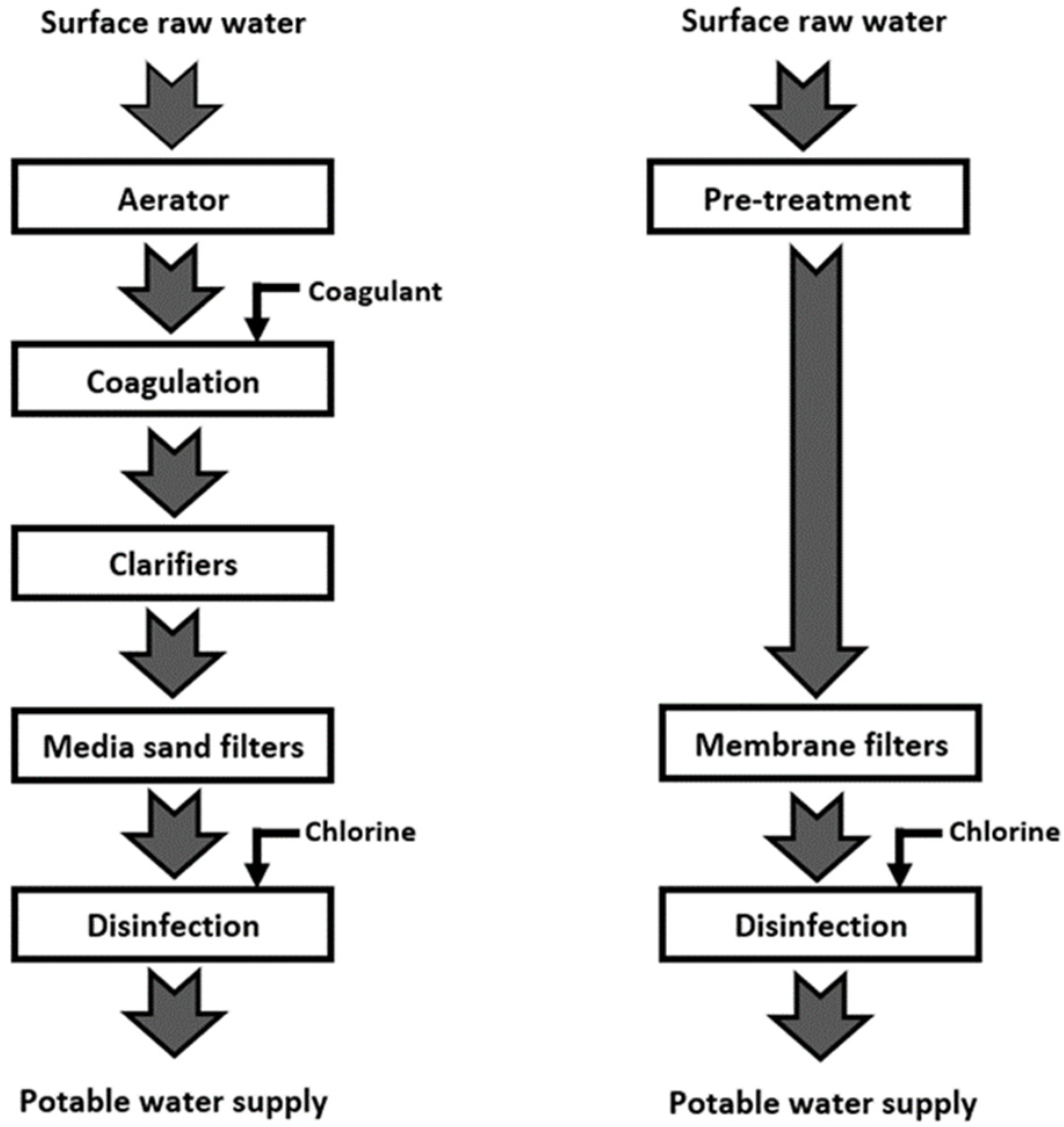

Membranes Free Full Text A Review On The Use Of Membrane Technology Systems In Developing Countries Html

How To Submit Tax Information Form In Google Adsense For Youtube I Step By Step Guide In English Youtube

Vat And Sales Tax Fastspring Docs

Vizio 43 Class Mq6 4k Uhd Quantum Led Lcd Tv Costco

Specialized Brain All Versions Rear Shock Improved Full Service Rebuild Kit Ebay

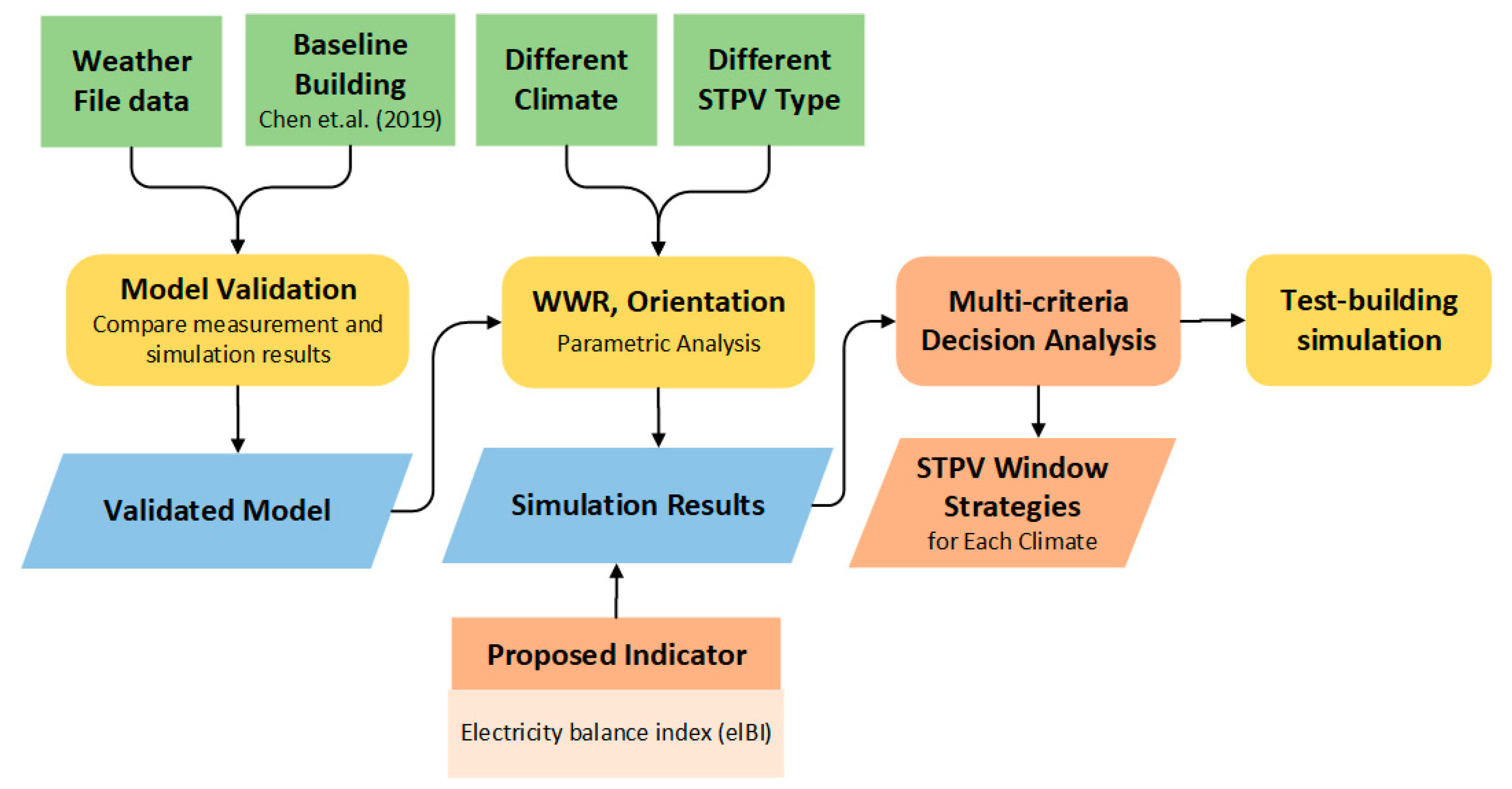

Sustainability Free Full Text Multi Criteria Performance Assessment For Semi Transparent Photovoltaic Windows In Different Climate Contexts Html

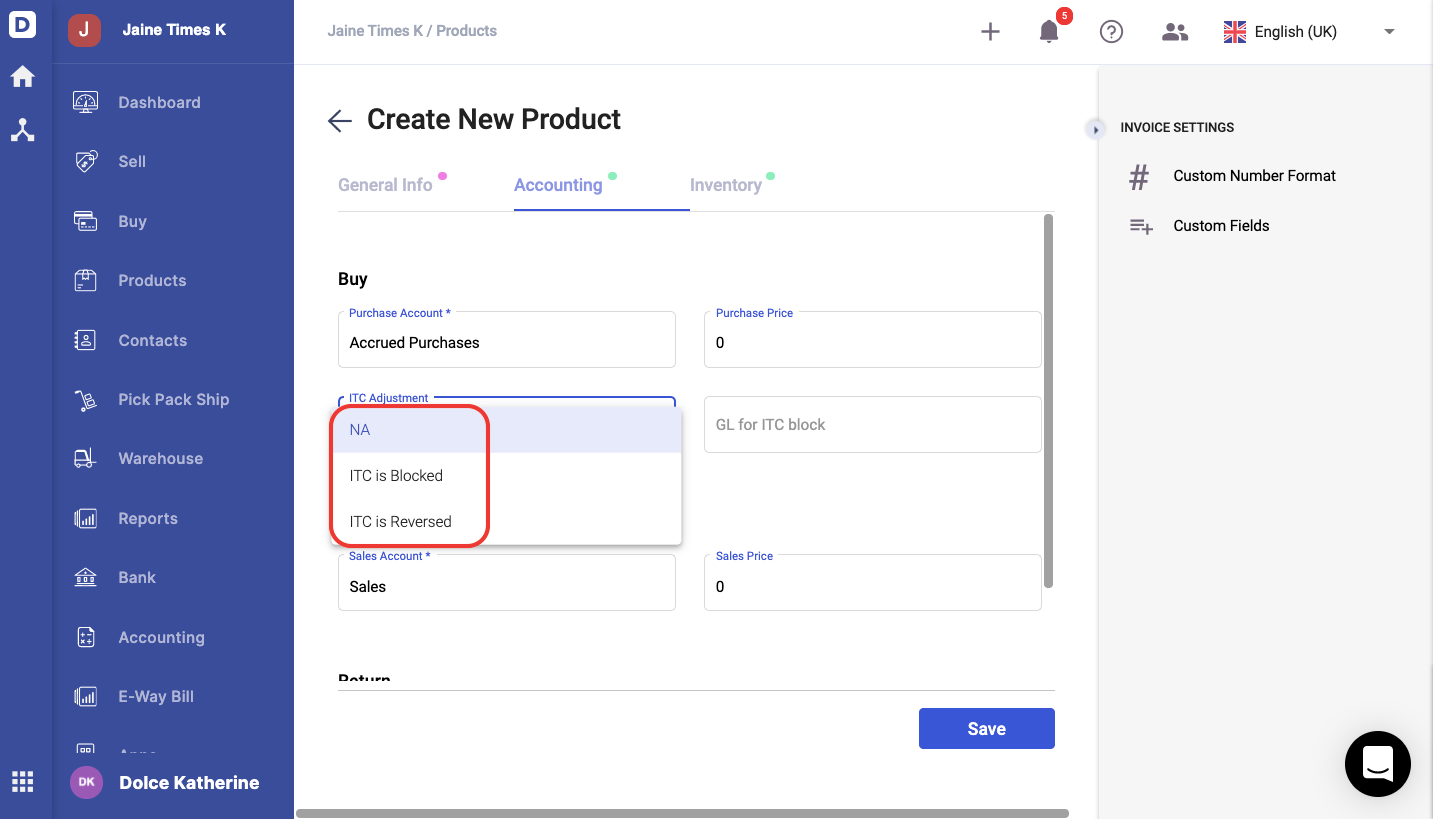

India Gst What Is Input Tax Credit Reversal In Gst

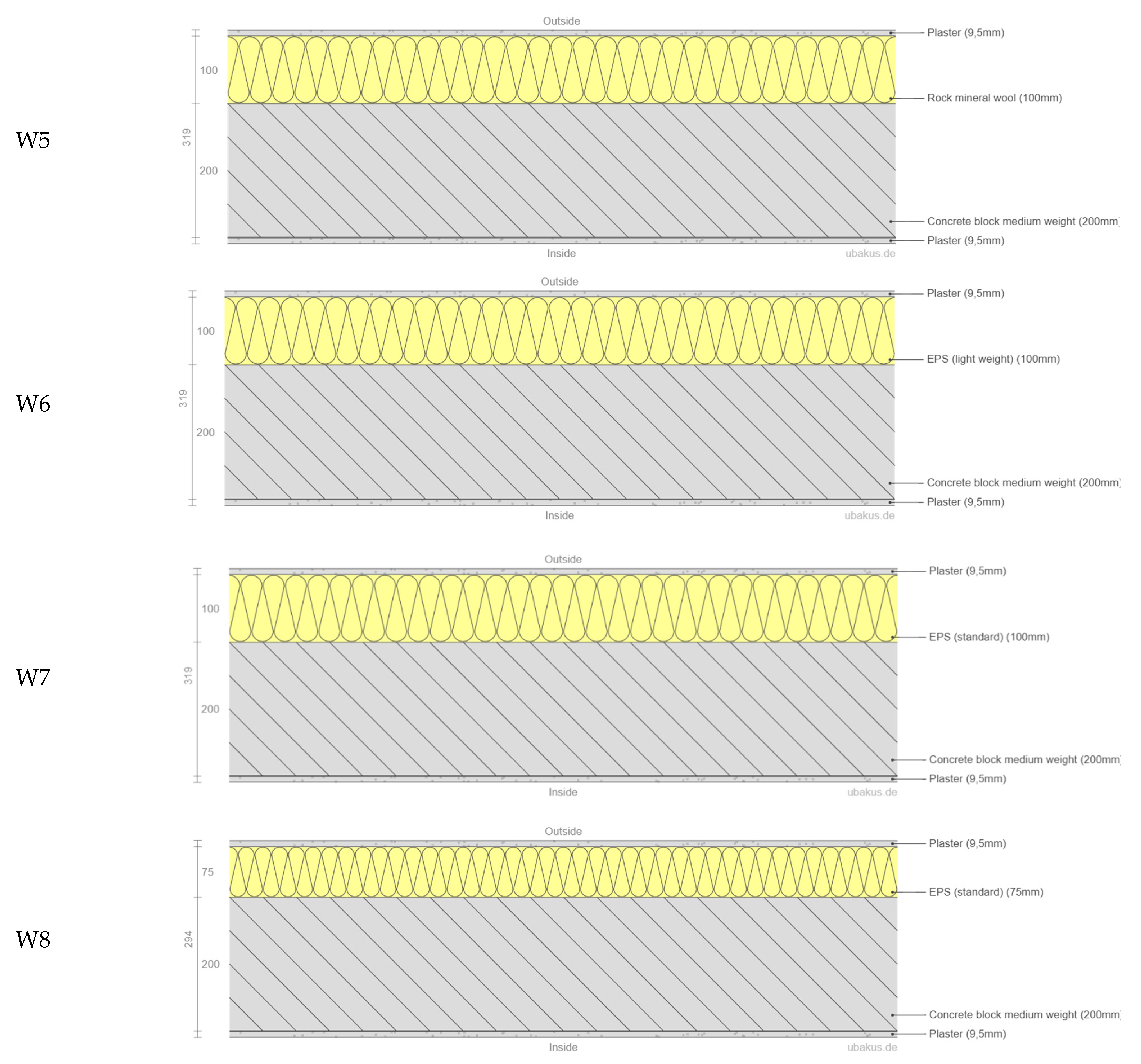

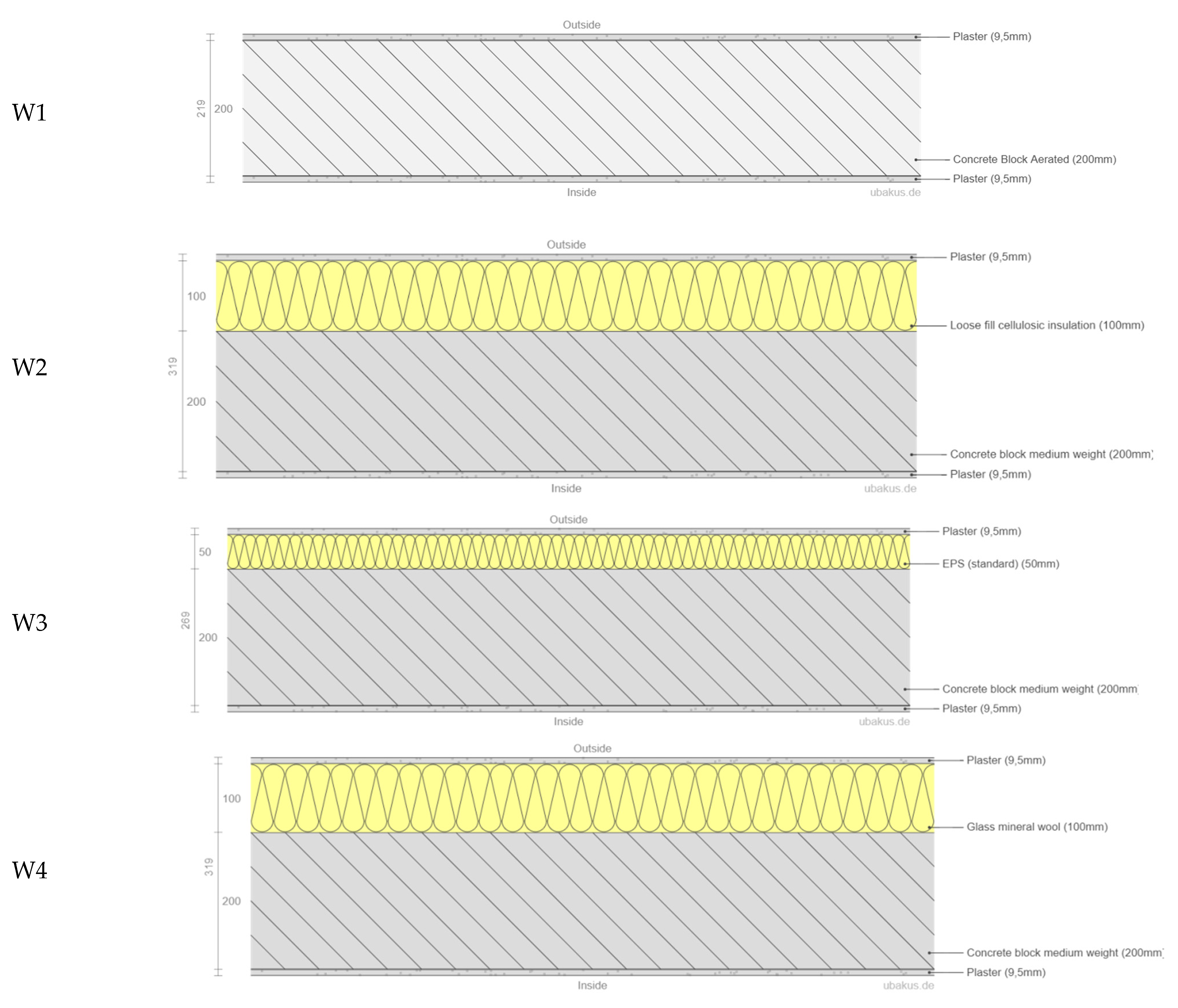

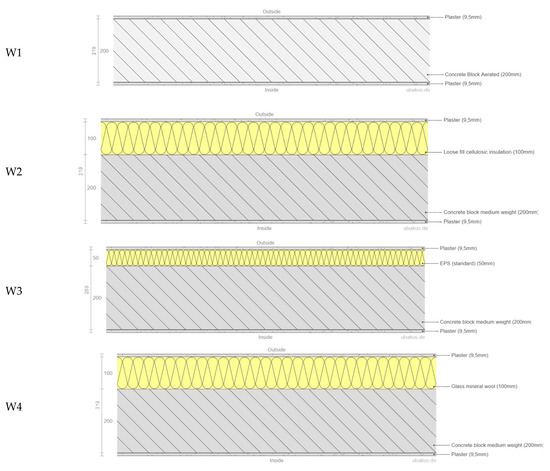

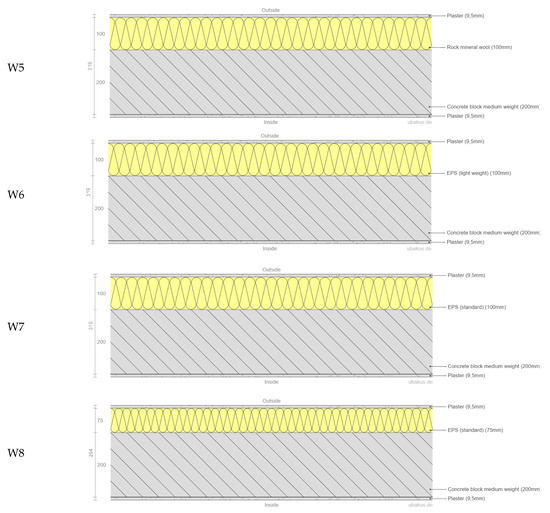

Sustainability Free Full Text Impact Of Passive Energy Efficiency Measures On Cooling Energy Demand In An Architectural Campus Building In Karachi Pakistan Html

Laos Indirect Tax Guide Kpmg Global

Sustainability Free Full Text Impact Of Passive Energy Efficiency Measures On Cooling Energy Demand In An Architectural Campus Building In Karachi Pakistan Html

Is Olive Garden S Problem That It S Serving You Too Many Breadsticks The Washington Post

India Gst What Is Input Tax Credit Reversal In Gst

Sustainability Free Full Text Impact Of Passive Energy Efficiency Measures On Cooling Energy Demand In An Architectural Campus Building In Karachi Pakistan Html

Soumik Ray Partner Sen Ray Chartered Accountants Linkedin

Korea Republic Of Indirect Tax Guide Kpmg Global

Sustainability Free Full Text Impact Of Passive Energy Efficiency Measures On Cooling Energy Demand In An Architectural Campus Building In Karachi Pakistan Html